car lease tax deduction canada calculator

Lost Interest on Lease. Or more before the HST to be a luxury vehicle.

As the holder of the lease you are required to make a down payment followed by set monthly payments.

. Car Lease Calculator Explorer. Lemon Aid New Car Reviews APA Recently Driven Road Tests Lemon Aid Used Car Reviews Recalls and Tech Tips Tire Info and Ratings Making Your Vehicle Last Longer Find A Reliable Repair Facility Mechanical Maintenance Tips Body Maintenance Consumer Tips and Advice Lease Takeover Information Returning your leased vehicle. Line 9819 for farming expenses.

Enter the total number of days the vehicle was leased in 2021 and previous years. In the same example as above if you use the vehicle. In this case the formula will look like this.

So the same is going to apply to the type of vehicle that you are leasing. You can deduct costs you incur to lease a motor vehicle you use to earn income. Enter the total lease charges paid for the vehicle in 2021.

Net cost of lease. Enter the cars MSRP final negotiated price down payment sales tax length of the lease new car lending rate and the cars value after the lease ends. This means that if your lease cost is 950 per month before HST youre restricted to claiming only 800 each month.

This is calculated as. Insurance Monthly Insurance Estimate. Comparison Through a Case Study.

Enter the manufacturers list price. You can use a leasing calculator to estimate how much it will cost you to borrow money to buy a vehicle. As of 2019 your deduction limit is 800 per month plus HST for your monthly lease payments which gives you a maximum 9600 annual tax deduction.

Ranked as the 1 Car Payment Calculator Tool in Canada you can Explore more than 1000 offers. Rogue S CVT 2WD. Now add GST and PST to 800 and multiply that amount by the total number of days you leased your vehicle during the year and divide the total by 30.

Your eligible leasing cost is the lower of the amounts on line 7 and line 8. When you use a passenger vehicle to earn farming or fishing income there is a limit on the amount of the leasing costs you. The ruling the CRA has on luxury cars purchased applies to depreciation.

30000 Sales taxes X total lease payments. Enter the total number of days the vehicle was leased in the tax year and previous years. To compare the deductibility of purchasing vs leasing a car we will look at a case study.

Total up Front Costs capital reduction other fees Total Lease Payments. Line 9281 for business and professional expenses. The types of expenses you can claim on Line 9281 Motor vehicle expenses not including CCA of Form T2125 or Form T2121 or line 9819 of Form T2042 include.

With the calculator you can easily try out different down. Lets say you use your rented vehicle for business 75 of the time and your lease payment is 400 per month. While the interest rate is a factor the down payment you are able to pay up front and the length of the term can have a large effect on the total amount paid for the vehicle.

Fuel and oil costs. We offer car diagnostic tools and automotive shop equipment such as the best code readers obd2 scanners refrigerant recovery machines wheel alignment tire balancing hoists and car lifts for garages. You can deduct 75 of 400 or 300 per month or 3600 per year plus HST.

The calculator will estimate the. CADmonth x 60 months. HST 35294 x 15 5294.

85 list price or 35294 sales tax whichever is more As with a purchased vehicle lease payments are also capped to the equivalent of a lease payment for a 30000 vehicle. Chart - Eligible leasing costs for passenger vehicles leased after December 31 2000. Number of days the car was leased in 2021.

If your yearly lease payment is 4200 thats about 350 per month and your business use percentage is 80 you may be able to deduct 3360 on your tax return for that year. The All-new 2022 Rogue. The maximum amount that the CRA will allow for lease deductions is 800.

If you claimed your lease payments last year subtract last years amount line 20. When you lease a passenger vehicle you may have either a repayment owing to you or you may have imputed. Enter the total lease payments deducted for the vehicle before the tax year.

Include these amounts on. The CRA classes any vehicle that costs 30000. Say youre using your leased vehicle 75 of the time for business and your lease payment is 400 per month.

Subtract the residual value as supplied by the financial institution 18000 - 12500 5500. HST 30000 x 15 4500. The business deduction is three-quarters of your actual costs or 6000 8000 075.

This is the amount that needs to be amortized over the life of the lease. The lost interest on your lease includes any interest you would have earned at your investment rate of return on the lease options down payment security deposit and other fees. Lease payments made for 2021.

Enter the amount from line 4 or line 5 whichever is more. Enter the total lease payments deducted for the vehicle before 2021. You should definitely consider this when choosing to either buy or lease your business vehicle.

More simply you can take a. 800 13 x 181 30 5454. See Step 2 of Calculating motor vehicle expenses to find out how to deduct lease payments from your business taxes Tax benefit for zero-emission vehicles ZEVs In 2019 the CRA raised the maximum claimable CCA for ZEVs to 55000 plus the federal and provincial sales tax paid on up to 55000 of the cars purchase price.

Line 9281 for fishing expenses. 2022 Nissan Rogue S. Simply divide by the term 36 months to get the monthly depreciation.

You can deduct 75 of 400 which equals 300 per month or 3600 annually plus HST. Licence and registration fees. When leasing a vehicle the limit on deductible lease cost is 800 per month before HST.

When you sign a contract to lease a car you are entering into a legally binding agreement that gives you the right to use that vehicle for a set amount of time and given certain terms and conditions. Repayments and imputed interest. Interest on money borrowed to buy a motor vehicle.

Lease Calculator - Canada Auto Solutions are the official distributors of Launch and Besita home of Launch Creader Launch X-431 Pro. HST 800 x 15 120. Heres a simple example to help you understand this a little better.

Starting in 2019 your deduction limit is 800 per month plus HST for your monthly lease payments giving you a maximum annual tax deduction of 9600. However the amount you can deduct for tax purposes is restricted further.

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Is It Better To Lease Or Buy A Car For A Business In Canada

Are Car Repairs Tax Deductible H R Block

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

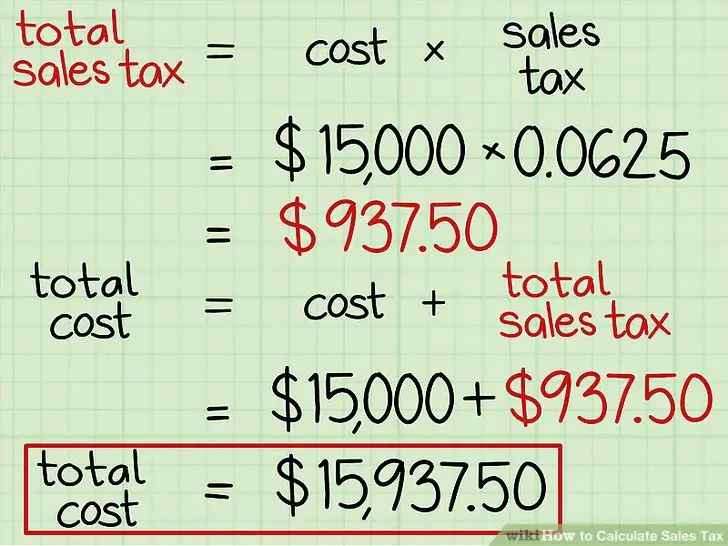

How To Calculate Sales Tax On A Car Carproclub Com

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Now That I Ve Filed Bankruptcy Can I Stop Paying My Second Mortgage Or Heloc Or Home Equity Line Of Credit Rob Second Mortgage Line Of Credit Home Equity

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

How To Deduct Car Lease Payments In Canada

Solved Sales Tax Deduction For Leased Car Personal Use

How To Deduct Car Lease Payments In Canada

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

What Is The Total Cost Of Owning A Car Nerdwallet Car Buying Driving School Driving